AFO 491 – Current lists of payment

In addition to detailed cash register overviews, which cannot be automatically updated on-line, the system has ‘on-line' overviews that are automatically updated each time a cash register transaction takes place. These overviews have a general nature.

AFO 491 offers the following options:

· Per session, the system displays an up-to-date overview of all amounts received and paid (or refunded) and of all special transactions, such as cancelled amounts. The system displays an overview per type of receipt (fine, loan charge, et cetera).

· The system makes it possible to enter a ‘start amount' (the amount in the cash register at the time the session is opened), to close a session and to register the amount actually present in the cash register.

· The system registers any discrepancies. Later, the differences can be viewed in what are known as password-related overviews (using AFO 492, ‘Financial overviews').

· The on-line overviews are displayed per session. Each day can be divided into one or more sessions. The sessions are coupled to a specific cash register.

· The division of the sessions gives libraries, if they so desire, the opportunity of ensuring that the compilation of the on-line cash register overviews coincides with any staff changes. Agencies that do not work in this manner can ignore the ‘session' concept. In the detailed cash register overviews (in AFO 492), the session concept is irrelevant. The only exception is the password-related overviews, which display the overviews of any cash discrepancies.

After choosing this AFO, a menu will be displayed.

The menu options are described in the next sections.

After choosing this option an overview screen will be displayed:

Title bar at the top of the screen: this contains information on the cash register and actual session, i.e.

· description cash register

· location code

· date

· session ID

· start time session

· either “open” or time that session was closed

Loan fees: Loan fees can be calculated when items are lent (AFO 411) and renewed (AFO 413).

Fines: Fines can be calculated when items are returned (AFO 412) and renewed (AFO 413).

Reservations: Reservation fees can be charged when reservations are submitted (AFO 421) or when an item for which a reservation has been submitted is lent (AFO 411).

Membership fees: The collection of the membership fee (subscription fee) is performed based on the borrower administration (AFO 431) for receipts through the cash register, based on AFO 433 for receipts through bank or giro accounts, or based on AFO 437 (‘Direct debit control') for payments made by means of direct debit.

Sale items: The sale of articles is performed using AFO 416 (‘Sale items') and can also be done completely transparently during Loans (AFO 411).

Postage: Postage fees can be calculated when overdues are sent. After a print file has been compiled (using AFO 451), the postage fees are automatically registered for the relevant borrowers.

Administrative fees: Administrative fees can be calculated when renewals with administrative fees are performed (e.g. by telephone) or when an invoice is sent using AFO 495 (‘Invoice control').

Security payments: As part of the borrower administration, a borrower can be requested to make a security payment (AFO 431).

Catalogue printouts: This option is nolonger in use.

Item fees: Item fees are created when certain invoices are generated (using AFO 495). See the description for this AFO for additional information.

Enrolment fees: A registration fee can be charged in two instances:

· the first time that a borrower is registered;

· when a borrower fails to renew membership within a certain period of time.

Registration of the enrolment fee is performed using AFO 431.

New membership cards: When a duplicate membership card is issued through the borrower administration (AFO 431), the system can charge a fee.

Miscellaneous: Receipts that are not described in the other categories are registered as miscellaneous. These are registered using AFO 417 ‘Refunds and miscellaneous payments'.

WebOPAC reservations: The system can charge a fee when a reservation is made through the webopac.

Services: Other charges.

Deposit payments: Fines, etc. can be paid for from a deposit in AFO 414 (Accept payments) or AFO 431 (Borrower Administration)

Deposit refunds: Deposit amounts can be refunded in AFO 417 (Refunds and miscellaneous payments) or AFO 431 (Borrower Administration).

Received: lists the amounts received per category

Special transactions: lists all amounts that are “paid” for which there is no actual money in the cash register (like chip card payments)

Repayment: lists the amounts refunded per category

TOTAL: The total amount (per column) received during the session.

Start: The amount put in the cash register at the start of the session. This can be the small change.

Grdtot: The total amount that should be in the cash register at this moment. Grand total = Total received minus Total refunded plus Start amount.

Cash: The amount in the cash register after physically closing the cash register. That is: the amount the staff member found in the cash register when closing it.

Difference: The difference between Grand total and Cash.

: Select this option to print the cash register overview. Then the standard output procedure is activated.

: Select this option to enter the start amount. Next an input screen will appear in which the start amount can be entered. The start amount is the amount of money present in the cash register at the beginning of the session:

Enter the amount of money in the cash register.

The amount can be changed during the session to make adjustments.

: Use this option to enter a comment for this session. When this option is selected, an input field will be displayed in which the comment can be entered. This comment is not shown on the screen, but will be printed on output.

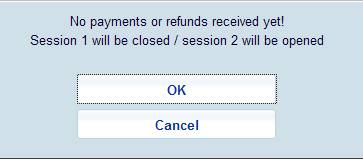

: Select this option to close the current session. When you select this option, a message will be displayed on the screen indicating which session is being closed and which session is being started. If no amounts have been received, the system will draw the user's attention to this fact with the message ‘No receipts registered'. However, this does not mean that the session cannot be closed:

Note

We advise you to close sessions at least once a day.

Click not to close the actual session.

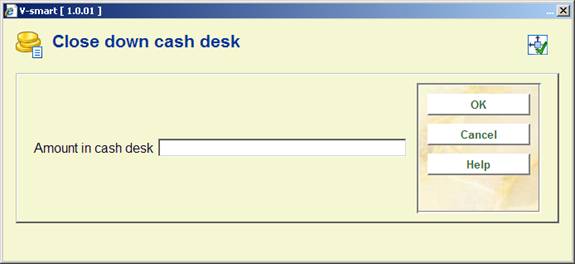

Click to close the actual session. After closing of the session is confirmed, the following session is immediately opened. This means that all new receipts, payments (refunds), et cetera will be registered in the following session, not in the session that was just closed. Then an input screen will be displayed:

Amount in cash desk: Enter the actual amount that is in the cash register. The system will note any discrepancy and will once again display the overview, but now with the new information.

This menu option can be used to view a different cash register overview. When you select this menu option, an input screen will be displayed

Enter in the order indicated and separated by a “/” (slash) a year, month, day, agency, location and cash register. If no entry is made in some of these fields, the system will apply the current value defined for your workstation. If you want to view all sessions of the current cash register, enter a “*” (star). In that case, a survey screen will be displayed in which the sessions are listed, from which you must select the desired session.

Then the system will display an overview screen with the cash register overview for the selected session. This screen functions in the same manner as that for the cash register overview with the option “Current session”.

Please note!

If an overview for a different agency/location is selected, the system will check to confirm access approval for that agency/location. If the user is not allowed access, the selected overview will not be displayed.

See the Pay Stations general help for more information.

The PayStation processing keeps a complete audit trail of all activity carried out on the paystation. The audit trail is maintained on the server and can be accessed from the main online to provide audit logs and information to help resolve any problems arising.

When the paystation is started up, library staff must run it up by logging in using a regular Vubis Smart login and password. This identifies the PayStation to the system, just as a regular login identifies the user. We would expect a specific login to be defined to the system for pay stations (.eg. PS1 or some such identifier), but technically this is NOT necessary.

To all intents and purposes therefore, transactions recorded on the system are therefore identified as if they had been carried out online by that user.

An audit trail will be kept of all actions carried out on the PayStation, not just successful payments. This audit trail may be accessed from AFO491 – for the current logged in user. In order to see an audit trail for PS1, say, the staff member must therefore log in to VubisSmart as “PS1”.

The Audit trail may be printed using the standard Print functions on the system (see any such “grid” processing in Vubis Smart) or may be printed by a special print command, which will allow a summary to be printed (along the lines shown) or a FULL listing for the given day (to include every event logged, down to the individual coins).

After choosing this option an overview screen will be displayed.

Only a summary of each transaction is displayed. A “running total” is shown which should correspond to the amount of cash in the kiosk.

: Selecting a specific line gives further details of the transaction – this depends on the specific line selected.

: On entry to the function the system shows a summary of what has happened on the paystation for “today”. Another date may be chosen by clicking on this button.

Note

Since the kiosk does not pay change, it is possible for the user to overpay. This extra cash is shown in the “current running total” display.

For a staff login there is nothing further of interest to display, but here are the two cases :

Borrower transaction: The system displays the individual coins entered; if there were any mistypes of PIN and so on.

For a Running total or Empty cash box, the following is shown: The system displays the individual coin amounts received and summarises the number of each type of coin, allowing a reconciliation to be made between what was recorded and what is actually in the cash box.

It is possible for the library to configure the system to generate reports on income in the way that the library wishes. It is the library's responsibility to configure and maintain these settings appropriately for them via AFO 494 and AFO 497.

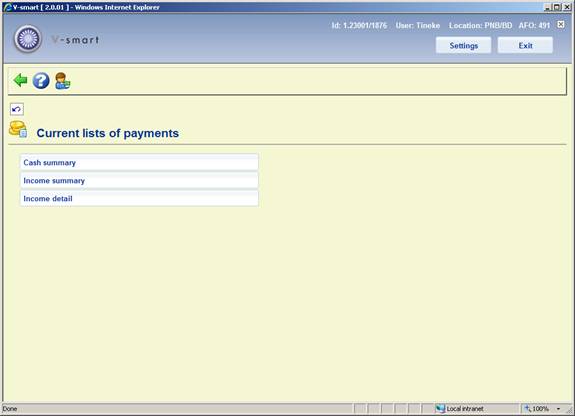

If so, then reporting will be available via this option of AFO 491. After selecting this option a sub menu will be displayed:

The various options are described in the next sections.

This report is based on VAT indicators, as defined in AFO 497 – Financial groups –Financial group management.

After selecting this option, an input form will be displayed:

Receiving location: A dropdown list from which * (All) locations may be selected, or a specific location. The dropdown list will show the (All) option first, followed by the current location and then other locations for the financial group for the current location only.

Date range: An option to use today's date only or the range of dates specified in the Start date and End date fields.

Payment method: You can move one or more specific methods to the right for reporting on those method(s) only. If no method is selected, the report will cover all payment methods in use. Possible payment methods are defined by the library in AFO 494 (Define cash codes) plus the "predefined" methods (Cash, Bank, Account, Giro, Credit/debit card).

Sort order: The preferred sort order for the report. The three possibilities are shown and the order may be defined by entering 1, 2, 3 against each setting. (If a specific date, specific location, specific payment method is selected, then of course the option for that field is irrelevant).

If NO sort order is defined for a specific field, then the totals will be aggregated for that selection. For example, if ALL payment types are selected, then leaving the Sort order/Payment method blank will cause the system to total all the payments; if defined, then the system will enumerate the totals for each type of payment method.

If more than one selection field has an "All" setting, then a sort order MUST be defined.

Report title: A report title which may be changed. The default is "Payment summary by VAT indicator".

Lines per page: Number of lines per page, default 50; for textual output.

After entering the required data, you can click . The system will switch to the standard screen for generating output.

This report summarises the payments made, according to the selection, grouping them by the charge group code, as defined in AFO 497 – Financial groups – Charge groups.

After selecting this option, an input form will be displayed:

Account credited: In this case, this is the location to which the money notionally belongs. The dropdown list will show the (All) option first, followed by the current location and then other locations for the financial group for the current location only.

Date range: An option to use today's date only or the range of dates specified in the Start date and End date fields.

Payment method: You can move one or more specific methods to the right for reporting on those method(s) only. If no method is selected, the report will cover all payment methods in use. Possible payment methods are defined by the library in AFO 494 (Define cash codes) plus the "predefined" methods (Cash, Bank, Account, Giro, Credit/debit card).

Charge type: allows a selection of a set of types of charges. Valid options are:

· Sales the report will include "sales items" only

· Miscellaneous the report will include miscellaneous payments (via AFO 417) only

· Invoiced the report will include only miscellaneous payments for which an invoice/reference number was entered in AFO 417

· General All the other types of charges

· All All charges

Report title: A report title which may be changed. The default is "Income summary by group".

Lines per page: Number of lines per page, default 50; for textual output.

After entering the required data, you can click . The system will switch to the standard screen for generating output.

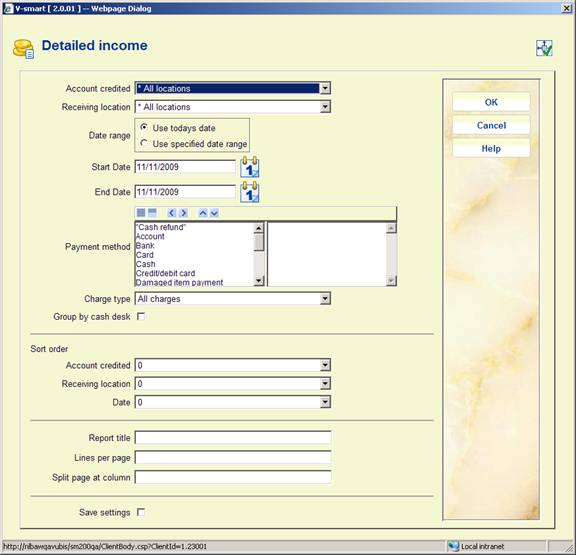

This report allows for the detailed reporting of the payments against charges individually.

After selecting this option, an input form will be displayed:

Account credited: In this case, this is location to which the money notionally belongs. The drop down list will show the (All) option first, followed by the current location and then other locations for the financial group for the current location only.

Receiving location: A drop down list from which * (All) locations may be selected, or a specific location. The drop down list will show the (All) option first, followed by the current location and then other locations for the financial group for the current location only.

Date range: An option to use today's date only or the range of dates specified in the Start date and End date fields.

Payment method: You can move one or more specific methods to the right for reporting on those method(s) only. If no method is selected, the report will cover all payment methods in use. Possible payment methods are defined by the library in AFO 494 (Define cash codes) plus the "predefined" methods (Cash, Bank, Account, Giro, Credit/debit card).

Charge type: allows a selection of a set of types of charges. Valid options are:

· Sales the report will include "sales items" only

· Miscellaneous the report will include miscellaneous payments (via AFO 417) only

· Invoiced the report will include only miscellaneous payments for which an invoice/reference number was entered in AFO 417

· General All the other types of charges

· All All charges

Group by cash desk: The report allows the specific device used to accept payment to be reported, OR, if the cash desks are defined and used, then the cash desk is displayed. If this option is checked, the cash desk rather than the device is displayed. For output to a spreadsheet then both settings are always reported.

It should be noted that BOTH Account credited AND Receiving location can be specified individually or as "All". This means that this report can be used to detail all the individual payments received at a given location, or detail all the income due to a given location.

Sort order: The preferred sort order for the report. The three possibilities are shown and the order may be defined by entering 1, 2, 3 against each setting. (If a specific date, specific location, specific payment method is selected, then of course the option for that field is irrelevant).

If NO sort order is defined for a specific field, then the totals will be aggregated for that selection. For example, if ALL payment types is selected, then leaving the Sort order/Payment method blank will cause the system to total all the payments; if defined, then the system will enumerate the totals for each type of payment method.

If more than one selection field has an "All" setting, then a sort order MUST be defined.

Report title: A report title which may be changed. The default is "Income summary by group".

Lines per page: Number of lines per page, default 50; for textual output.

Split page at column: The width of the output for printed output is unlikely to fit on a regular page. The system will optionally print two pages per line of output (pages 1a, 1b) – this is similar to the way that spreadsheets typically print (columns 1-n on printed sheet 1, then n-m on printed sheet 2 and so on). Since this depends on the way that the user will print the information (e.g. landscape or portrait), what the default font size is etc- then which column to split at is a runtime option.

After entering the required data, you can click . The system will switch to the standard screen for generating output.

· Document control - Change History

|

Version |

Date |

Change description |

Author |

|

1.0 |

June 2008 |

creation |

|

|

2.0 |

November 2009 |

minor upates; new option income management reports |

|